A new poll commissioned by the Service Employees International Union shows a “gross receipts tax” on businesses would get more voter support than the sales tax that has been polled to date.

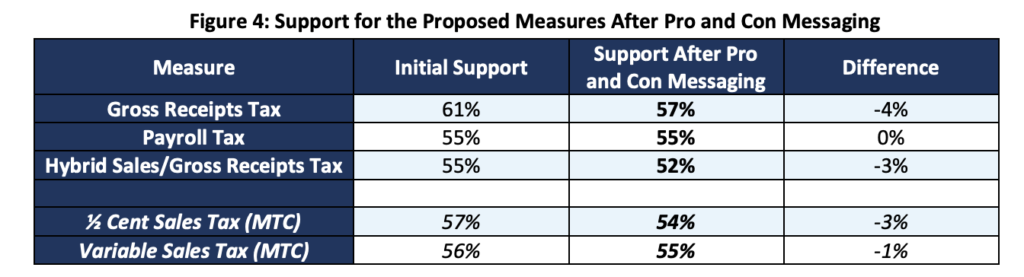

The poll asked likely November 2026 voters whether businesses should pay their fair share to support public transit. The business gross receipts tax ended with +21% support (57-36%) after both positive and negative messaging, while the sales tax was +10% (55-45%).

The poll covered four counties (San Francisco, Alameda, Contra Costa, San Mateo), because it was conducted before polling results in Santa Clara County lead VTA toward greater consideration about potentially participating in a regional measure.

Time is short for the San Mateo and Santa Clara Counties to make decisions about joining the regional measure (by August 11) and for the bill to pass and be signed by the governor (September/October). While details are being worked out regarding the measure’s expenditure plan, there is an opportunity to assess the potential for a business tax that could raise more money and be less regressive, landing harder on lower income peoplw with less ability to pay. SEIU is doing additional analysis about options to exempt small business (which has been important for other successful local business taxes).

Friends of Caltrain has supported previous local business taxes for transportation where feasible and is part of the Voices for Public Transportation Coalition that has long supported progressive funding.