On Thursday, February 2, the Caltrain board will discuss short-term opportunities to regrow transit ridership. Caltrain is looking at single agency strategies that it can fully control.

These strategies will be helpful, but this narrow focus on short-term independent actions underestimates the depth of the challenge Caltrain is confronting. The railroad is struggling to break even 30% of its pre-COVID ridership and is still drifting toward a daunting fiscal cliff, though the cliff has been delayed for a short time thanks to state funding to complete electrification.

The previous business model of commuter rail operating as a single line, supported financially by the high fares paid by daily white-collar commuters is no longer viable- especially in the Bay Area. To regrow ridership and achieve long-term financial stability the Caltrain needs a multi-step strategy making use of electrification and working with the region to transform into something new.

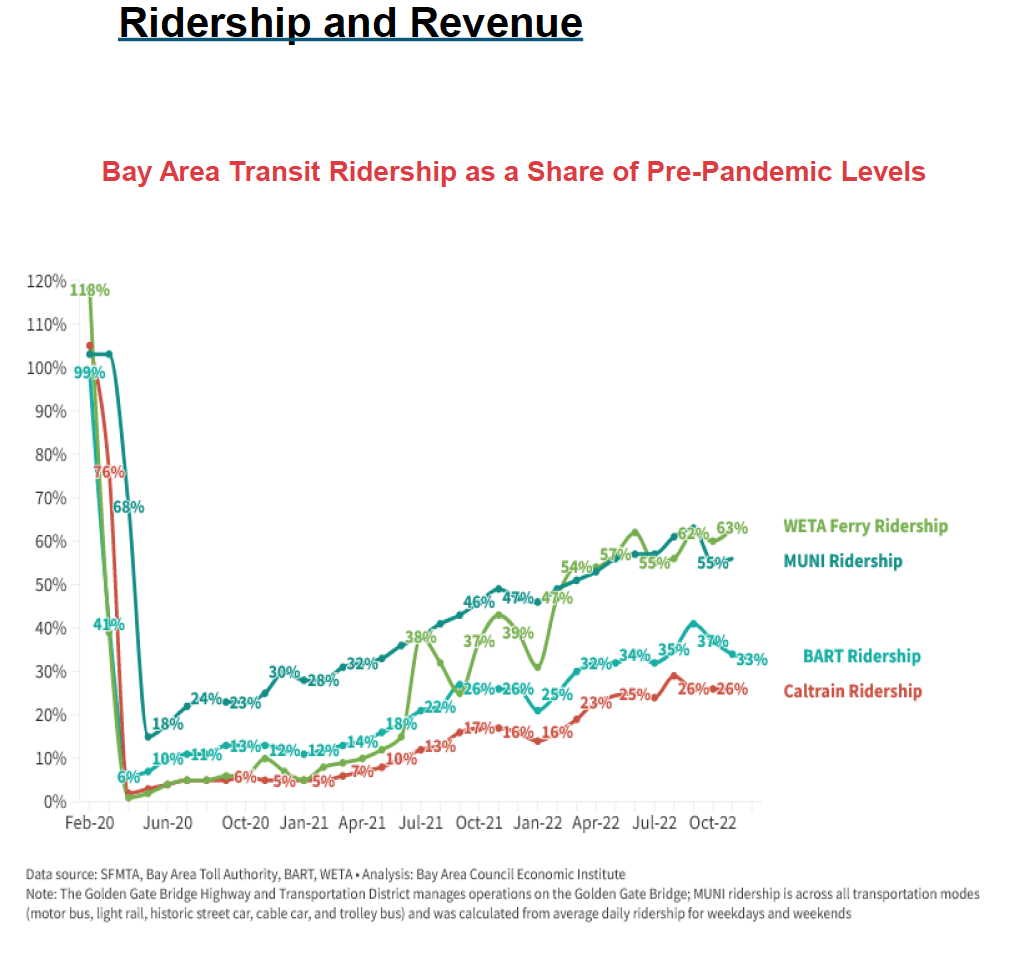

Slow ridership recovery for the Bay Area and Caltrain in particular

The Bay Area in general has had slower ridership recovery than regional transit services around the US and North America. This is correlated with a greater share of working from home in the Bay Area than in the rest of the country. And Caltrain’s ridership has been among the slowest to grow back from steep pandemic declines.

Looking to US rail agencies and single-agency strategies

In planning its ridership regrowth strategies, Caltrain is looking at 5 agencies it considers peers in the United States, including SEPTA (Greater Philadelphia area), Sound Transit (Seattle metropolitan area), Metra (Chicago metropolitan area), Metrolink (Southern California), and Virginia Railway Express (Northern Virginia).

And Caltrain plans to focus on strategies over which it has full and direct control, such as single-agency fares, promotions, service, and marketing campaigns.

Given the time-sensitive need to complete Caltrain electrification, it is also important to consider on-time performance where possible, and taking extra care to communicate to riders when there are delays and service changes.

Additional models for Caltrain ridership regrowth – BART, WETA, Toronto, Vancouver

Caltrain’s ridership regrowth proposal does not yet look at BART, the peer agency which delivers most of the rest of the Bay Area’s regional transit. BART ridership remains low compared to pre-pandemic levels but is ahead of Caltrain with 40% of pre-pandemic ridership on days with higher work-commuting, and 50-70% of pre-pandemic ridership on weekends.

And Caltrain isn’t yet looking at WETA, which (though small) has the highest ridership regrowth rate among all of the Bay Area’s regional agencies.

Also, Caltrain isn’t yet looking at services in Canada, in metros that have similar land use and economies as US metros, but have seen much stronger ridership regrowth.

Integrating service with BART

A clue to important strategies can be found in Caltrain’s statistics about ridership for trips with BART connections.

Caltrain and BART have worked to provide more seamless connections at the Millbrae Transit Center, bringing many weekday connections to between 8 and 15 minutes. Transfers reached 60% of pre-Covid levels this past summer despite overall weekday ridership levels plateauing at 30% of the 2019 baseline. Improving Caltrain/BART schedule connections has had a disproportionate benefit in ridership.

Along similar lines, the Bay Area’s Fare Coordination and Integration study, with recommendations approved in 2021, concluded that harmonizing regional agency fares – logically starting with BART and Caltrain – would significantly increase ridership – up to 68,000 new riders, equivalent to pre-Covid Caltrain. While the ridership base today is lower, and therefore the proportionate increase would logically be lower – integrating fares with BART nevertheless seems like an important component of a ridership growth strategy.

WETA’s successful strategies

As shown in the chart above, WETA’s ridership regrowth is the strongest among Bay Area regional services. In planning for pandemic recovery, WETA – which before the pandemic had ridership that was very heavily oriented toward white collar commuting, with high fares and a schedule focused on office work peak periods – unilaterally changed their fares and schedules in July 2021. WETA reduced its fares to be more comparable with alternative transit options such as BART. And WETA adjusted its schedules to do a better job serving the essential workers who continued to ride when white collar workers stayed home, and serving weekend leisure trips. The July 2021 changes offering new more affordable fare structure, combined with promotions and service increases, generated a ridership jump.

Today, WETA’s highest ridership line is the Vallejo line serving many blue collar workers. Their stats show many new riders in lower income brackets. Their weekend ridership has risen above pre-pandemic levels.

Examples in Canada

In Toronto, GO Transit ridership on weekends is booming, and exceeded pre-pandemic levels over the summer, following the introduction of a weekend pass. In Metro Vancouver, ridership has recovered to 80% of pre-pandemic levels, following a collapse to 17% during the shelter in place period. But even in Vancouver, farebox recovery levels remain much lower than pre-pandemic levels and the agency is seeking additional long-term sources of revenue for public transit. Canadian metropolitan regions have similar land use patterns as the US, and there are likely to be relevant lessons from these peer systems as well.

Who are Caltrain’s riders now?

According to Caltrain’s most recent rider data presented at a recent meeting of the Bicycle and Active Transportation advisory committee, less than half of riders had access to a car for the trip they were taking. This isn’t just a post-Covid phenomenon – the trend started well before the pandemic.

Also, like other regional services, Caltrain ridership has been regrowing faster for weekend trips than weekday trips. Weekday ridership is still more than twice weekend ridership, but is only about 30% of pre-pandemic level.

Caltrain’s ridership growth strategy seeks to understand the target audience, including “Peninsula Corridor residents including frequent, infrequent, and lapsed riders, as well as those who have never ridden Caltrain.” However, since many of these riders do not have access to a car for their trips, it will be important to understand these customers broader transit needs – not only for Caltrain service, since it may require more than just one agency’s service to meet those needs. Also, considering the disproportionate growth in riders making the BART connection, this raises a question about riders who may live outside the Peninsula Corridor off a BART line.

Multiple steps to recovery, including multi-agency regional service strategies and new regional funding

Many of the promising ridership growth strategies seen elsewhere focus on growth in trips by people other than white collar commuters, outside of peak white collar commute periods.

Unfortunately, weekend ridership strategies will be off the table in the coming year. Because of the need to accelerate electrification construction, Caltrain needs to implement weekend service full and partial closures in 2023.

Clearly, Caltrain’s ridership regrowth strategies will require multiple steps. It is understandable that Caltrain is planning short-term actions that it can fully control. In the short and medium term, however, there are already programs in the regional Transformation Action Plan, including regional fare and schedule coordination, that have strong potential to contribute to ridership regrowth.

Caltrain’s Equity and Connectivity strategies that started development before the pandemic identified opportunities to diversify and increase ridership that required better fare and schedule connections with other transit for riders who have less income and less access to driving. And these strategies require connections across multiple agencies.

Even if these changes can’t be done instantly and require multiple agencies, it is essential for the strategy and planning to start now, and important for Caltrain to pursue these multi-step and multi-agency strategies.

As in Canada, and as discussed in BART’s planning including BART’s recent board meeting – the multiple steps to recovery will need to include additional revenue. Given the slow path to ridership regrowth, and the need to diversify ridership, fares will represent a smaller share of revenue in the foreseeable future. Because Caltrain has so recently passed a Caltrain-specific ballot measure, another three-county measure seems challenging.

A potentially strong opportunity for revenue could be working as part of a regional measure strategy that goes beyond three counties. Such a strategy would have the advantage of funding highly popular ridership-building regional integration initiatives (see polling data in chart below). But discussion of these initiatives are not yet included in Caltrain’s ridership recovery strategy.

The multi-agency strategies pose some potential risks to Caltrain’s finances – but also pose important opportunities to bring in new revenue sources. And there are opportunities to use those new revenues in ways that prevent those risks.

Beyond commuter rail

Well before the pandemic, it was clear that the North American model of “commuter rail” – focused on white collar commuting hours, and disconnected from other parts of the transit system – underperformed regions around the world that serve more kinds of riders and more kinds of trips.

The commuter rail model itself is in trouble – such commute-focused services are underperforming other transit around the US according data from the American Public Transit Association.

Importantly commuter rail isn’t a technology – it is a service model based on strategic choices to focus on peak commute periods for white collar commuters, and to charge fares intended for affluent white collar commuters. These days, the underperformance of the standalone commuter rail model is an existential threat. Caltrain can start with single-agency actions it can fully control, but important ridership growth strategies transcend agency boundaries.

Thursday’s board agenda does not yet dive into a multi-step, multi-agency strategy, including new revenue, to evolve Caltrain as part of an integrated regional rail and transit service. There will be an upcoming board budget workshop in March that has the opportunity to delve more deeply into revenue needs and multistep opportunities to address the budget challenges.